Our payroll services

Whether you operate solely in Singapore or have a presence in other countries across the Asia-Pacific region, BoardRoom can help with all your payroll outsourcing needs.

Our team of highly trained payroll professionals can help you navigate Singapore’s ever-changing payroll compliance regulations. As well as looking after your payroll administration, they are available to answer any questions you have and provide solutions to any potential payroll issues.

We can help with:

- Computation of gross to net salary and CPF

- Provision of payroll detail, variance reports and payroll journals

- Disbursement of employees' net salary, CPF and issuing confidential payslips (hard copy or electronic)

- Preparation of year-end IR8A forms and appendices (hard copy or electronic)

- Preparation of IR21, GML, NS MUP, CPF refund, government statistics forms, etc., per the Singapore Employment Act

- Electronic administration of employees’ leave and expense claims

We offer payroll outsourcing services in 19 countries and regions, including:

Singapore

Singapore Australia

Australia China

China Hong Kong

Hong Kong India

India

Indonesia

Indonesia Japan

Japan Macau

Macau Malaysia

Malaysia

Myanmar

Myanmar New Zealand

New Zealand Philippines

Philippines South Korea

South Korea

Thailand

Thailand Taiwan

Taiwan UAE

UAE Vietnam

Vietnam

We also offer flexible payroll solutions with options to either:

- Centralise coordination through BoardRoom Singapore; or

- Decentralise coordination via our network of local offices.

We can help with:

- Payment and lodgement of local statutory obligations and filings

- Processing of multi-country pay runs;

- Combined payroll and tax services;

- Electronic management of employees’ leave and expense claims; and

- International payroll services.

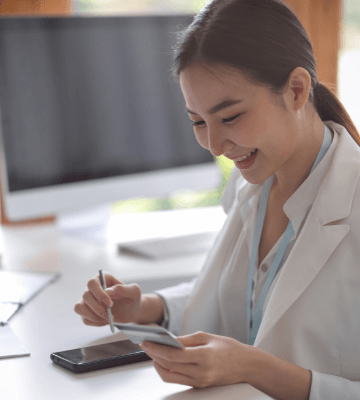

Our payroll services are powered by Ignite, our payroll software. This future-forward solution eliminates the need for multiple systems, offering unparalleled reporting capabilities and a seamless online multi-country payroll process experience.

With Ignite as your payroll processing platform, you can enjoy a integrated HRMS with leave and claims processing, ensuring full statutory compliance across nine Asian countries, including Singapore. With an intuitive mobile app for employee self-service, attendance tracking and a dedicated account manager as a single point of contact, our payroll processing platform empowers leaders with greater visibility and control.

Frequently Asked Questions (FAQs)

1. How do outsourced payroll services work?

Outsourced payroll services mean that you hire a third-party company to take care of your payroll services. This is particularly useful for companies that are struggling to keep up with local regulatory compliance or a growing workforce. By outsourcing, you will ensure that your employees are paid accurately and on time, and you will also have peace of mind that your business is fully compliant with local regulations regarding mandatory contributions.

There are various types of payroll solutions tailored to different business needs. You can adopt a full outsourcing solution where the vendor takes care of everything from calculating disbursements to pay runs and reporting. Alternatively, you can adopt a simpler solution that just entails completing the monthly pay run with data supplied by the client.

2. How to choose the right payroll and HR service for your business?

When it comes to payroll and HR services, it’s important to understand that different businesses require different solutions.

The best way to find a payroll solution that fits your business is to first identify what your business needs. Will you need real-time calculations? How about paychecks and direct deposits? Tax filing services?

By identifying your needs, it will be easier to determine which payroll and HR services can best suit those needs. If you need any help identifying your business’s needs, give us a call today.

3. What are the pros and cons of outsourcing payroll?

While this will vary for each business, here are some of the more commonly voiced pros and cons of outsourcing payroll to a third-party service provider.

Pros

- Your taxes will be filed in compliance with tax laws and regulations

- Outsourcing can be less costly than hiring someone full-time

- Your employees will be paid on time, and your business will be fully compliant with local statutory requirements

Cons

- You could possibly be paying for services that your business doesn’t need

- You’re putting highly sensitive payroll data in the hands of an external service provider

4. Is it more expensive to outsource payroll as compared to doing it in-house?

Typically speaking, handling payroll in-house is more expensive than outsourcing payroll.

This is because employing an in-house expert can be costly. Aside from mitigating cost from an operational standpoint, outsourcing your payroll can also reduce your fixed business costs by saving on technology infrastructure and implementation, as the responsibility falls on your outsourced service provider.

5. What software do you use for payroll management?

Here at BoardRoom, we use Ignite, an all-in-one software solution for our payroll management. This software helps businesses of all sizes automate their payroll, enabling them to increase productivity and efficiency.

Ignite HRMS has five core modules: payroll, leave, claims, time clock & attendance. It offers multi-country payroll processing, ensuring full compliance with local statutory obligations across nine countries in Asia.

6. What is multi-country payroll outsourcing?

Multi-country payroll outsourcing, also known as MCPO, is a service that enables businesses operating in multiple countries and currencies to manage their payroll and adhere to local best practices through a single provider.

MCPO can allow parallel comparison of payroll costs between countries through standardisation. For instance, a company can adopt a common definition of payroll cost, i.e., Allowance A, B and C, to make an effective comparison of cost performance for companies that operate across multiple countries. A sophisticated MCPO software is a must-have for any business or enterprise operating in various countries.

Secondly, payroll regulations in emerging countries can often change, leaving internal HR teams with insufficient knowledge and expertise to execute changes with their employees. Hence, companies can gain insights and understanding of local practices by leveraging an MCPO provider who has an in-depth knowledge of changing local regulations.

7. What is the difference between HR and Payroll?

The difference between HR and Payroll depends on the business in question.

While most businesses consider payroll to be a sub-function of their HR department, many companies don’t have HR departments and thus Payroll sits separately.

Basically, Payroll is the function associated with actioning your employees’ remuneration packages according to your agreed-upon pay cycle. Whereas the wider HR function is responsible for a wealth of other areas, including talent attraction and retention, employee benefits, employee training and development, and much more.

8. What services should payroll outsourcing companies offer?

At a basic level, a payroll service provider should be able to:

- Process payroll, including payments of salaries, bonuses and other remuneration items

- Provision of employee net pay file, funding request, i.e., local statutory contribution, and month-end payroll reports

- Administer the deposit of net payroll into the employee’s bank accounts

- Administer payment of local statutory contribution

- Preparation and submission of annual income tax and other local tax obligations

In the search for more comprehensive payroll outsourcing services, several outsourcing providers can offer their own proprietary HRMS system for their clients’ use. This allows companies to have full access to the HRMS system and add other modules, such as leave, claims, or time & attendance modules, tailored to their specific needs.

Alternatively, some companies can request the integration of their existing ERP system, such as SAP or Workday, with the service provider’s system by uploading payroll information into their system.

9. How secure is outsourcing payroll?

Outsourcing your payroll can be a secure option, but it is recommended to choose a reputable service provider that prioritises security and has the necessary experience to back it up.

Additionally, when evaluating reputable vendors, a good measure of their security is the certifications they hold. Some common certifications to look for in a payroll outsourcing vendor include ISO 9001, ISO 27001, and SOC2.

In Singapore, you can take this a step further and seek a vendor who has an Outsourced Service Providers Audit Report (“OSPAR”). Being awarded OSPAR indicates that a company is in full compliance with the Association of Banks in Singapore’s guidelines. To remain OSPAR certified, the payroll outsourcing service provider must have the relevant measures and controls in place and implement these consistently.

BoardRoom is proud to say we have attained official OSPAR certification for 3 years in a row.

10. How can BoardRoom help with payroll services?

Here at BoardRoom, we have the best tools and most secure software to help businesses handle their payroll. Our experienced staff can guide you through payroll management securely and efficiently. With regional experience and our winning payroll software, BoardRoom is fully equipped to handle payroll services for businesses of all sizes.

For more information on Payroll outsourcing or our Multi-country Ignite Payroll software, please contact us today.