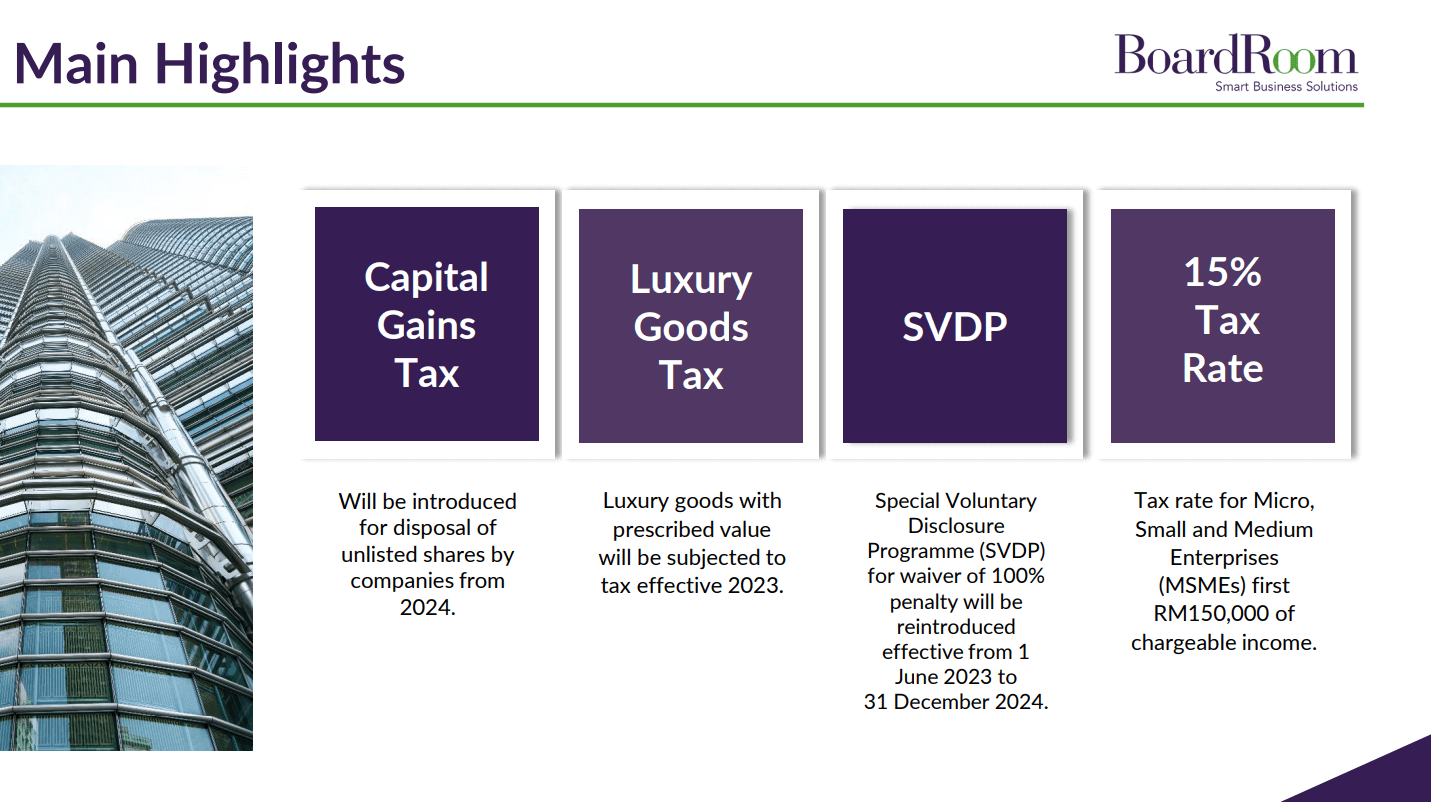

Malaysia’s 2023 Budget, which was re-tabled on 24 February under the new Unity Government, totaled RM388 billion. Almost 75% of its budget has been allocated to Operating Expenditure, signaling the Government’s commitment to drive its reform agenda and revitalise Malaysia’s economy.

Several tax incentives were announced as part of the Government’s strategy to drive an inclusive and sustainable economy. To find out how the tax measures announced will implicate your tax planning, download our Malaysia 2023 Budget Report today.

If you have any questions relating to the information contained in this report or require tax advisory services, please email our tax advisors at [email protected].

Should you have any questions regarding the information provided in the report, please do not hesitate to reach out to your respective BoardRoom client managers or email us at [email protected].

Best regards,

BoardRoom Team

Related Business Insights

-

07 Oct 2025

Employee Statutory Contributions: EPF, SOCSO, EIS & HRD

Learn how to manage Malaysia's statutory contributions, EPF, SOCSO, EIS & HRD, with clear guidance on compliance, b …

READ MORE -

11 Sep 2025

SSM Crackdown: Ensure Annual Return Compliance

Act now on annual return compliance in Malaysia. Learn what the SSM crackdown means and how BoardRoom Malaysia can …

READ MORE -

10 Sep 2025

Malaysia AGM Report 2025

Discover how you can navigate the busy AGM season effectively while balancing regulatory demands and stakeholder ex …

READ MORE