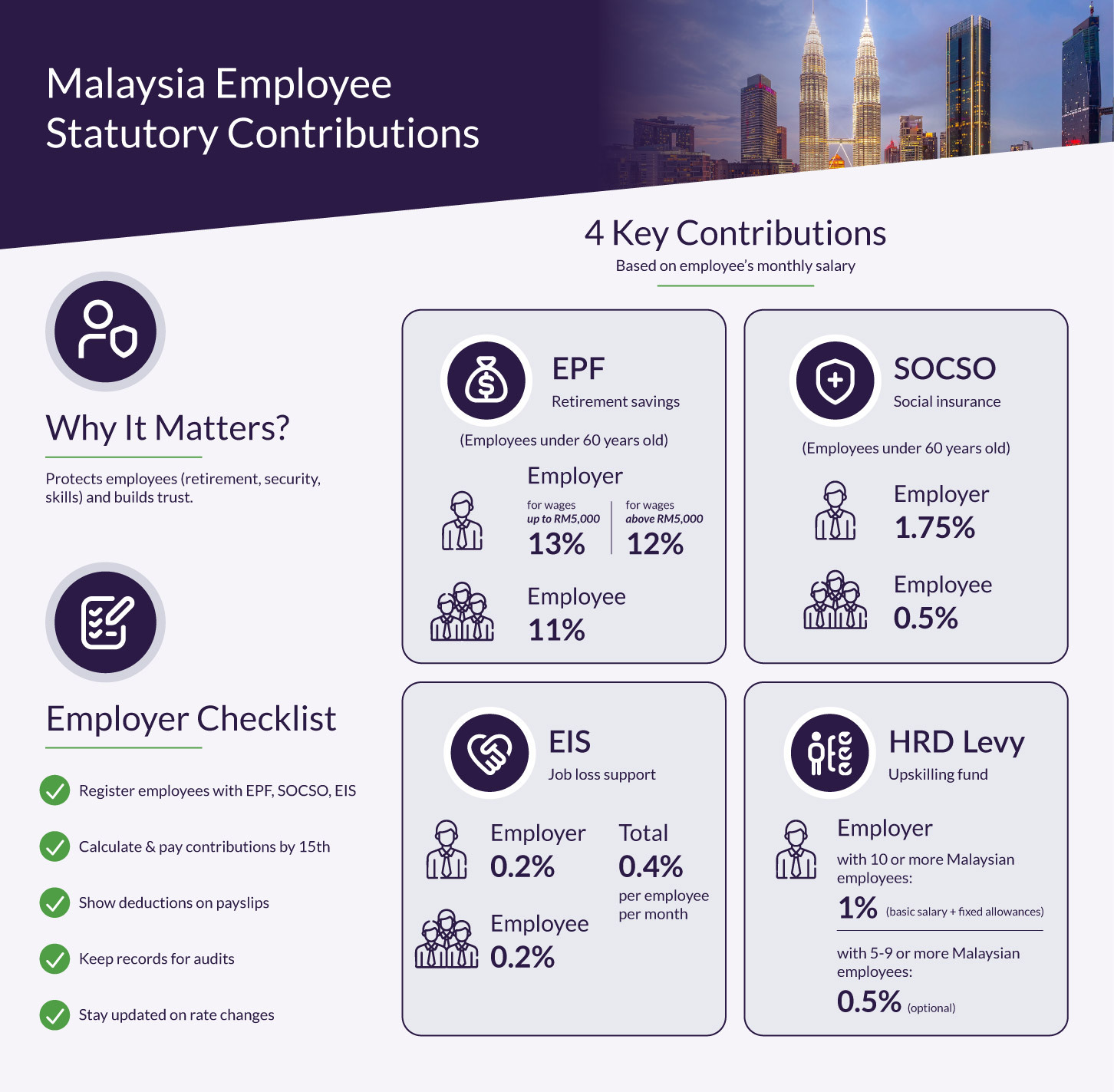

In Malaysia, statutory contributions form an essential framework that safeguards employees’ welfare, providing them with social protection, retirement savings, and access to training and upskilling programmes. Employers need to meet these obligations, as they mean upholding responsibility to staff and preserving the credibility of the business, essentially building employees’ trust in the organisation.

The Employees Provident Fund (EPF), the Social Security Organisation (SOCSO), the Employment Insurance System (EIS), and the Human Resources Development (HRD) levy are the four main statutory payroll contributions in Malaysia. In this guide, you’ll learn how each of them works, including key calculations, employee and employer obligations, and benefits, helping you navigate the challenging landscape of managing statutory employee contributions. A practical checklist is also included so you can take the proper steps to ensure compliance.

Understanding Each Statutory Contribution

Each of these statutory contributions helps establish a comprehensive system, which can benefit employees in the aspects of career development, occupational security, and retirement life, contributing to the wider economy.

EPF (Employees Provident Fund)

The EPF is Malaysia’s main retirement savings scheme, requiring mandatory contributions from both employer and employee. For employees under the age of 60 with a salary of RM5,000 or below, employers typically need to contribute 13% of an employee’s wages, while employees contribute 11%. The rates vary with other income levels and age groups.

Contributions are calculated from the employee’s monthly wages, and employers are required to remit the total sum to the EPF by the 15th day of the following month. Late payment may result in additional charges or penalties.

For employees, EPF contributions are critical to financial security after retirement. Balances grow over time with annual dividends declared by the EPF, and funds can be withdrawn under specific conditions, such as retirement, permanent disability, or reaching the statutory withdrawal age. This system ensures that employees are not left financially vulnerable in later life.

SOCSO (Social Security Organisation)

SOCSO provides social insurance protection, covering employees through two principal schemes: the Employment Injury Scheme, which offers protection in the event of workplace accidents or occupational diseases, and the Invalidity Scheme, which provides coverage for invalidity or death not related to employment.

Both employers and employees are required to contribute to SOCSO, with contribution rates determined by wage brackets and capped at specific ceilings. Typically, employers are required to contribute 1.75% of the employee’s monthly wage, while employees need to contribute 0.5%, provided they are under 60 years old.

Benefits available under SOCSO are extensive and include medical care, temporary disablement benefits, permanent disablement pensions, dependants’ benefits, and rehabilitation programmes. This safety net reassures employees that they and their families will receive support if unforeseen circumstances arise.

EIS (Employment Insurance System)

The Employment Insurance System was introduced to provide financial relief and job search support to employees who lose their jobs through retrenchment, redundancy, or other economic reasons. The scheme is applicable to all citizens and permanent residents in Malaysia aged between 18 and 60 years old working in the private sector, with certain exclusions, such as domestic workers, self-employed persons, and retirees.

Under the EIS, both employer and employee contribute 0.2% each of the employee’s monthly wage, subject to a wage ceiling. While the contributions are small in proportion to wages, they create a meaningful safety net for affected employees.

To submit a statutory contribution for EIS, employers must register on PERKESO’s Assist Portal first. After making the deductions, upload the contribution files and submit the payments on or before the 15th of the following month.

Employees who qualify can receive benefits such as job search allowances, training allowances, and career counselling services. The scheme also funds retraining and skills upgrading, helping displaced workers return to the job market with stronger employability.

HRD (Human Resources Development) Levy

The HRD levy, administered by the Human Resource Development Corporation (HRD Corp), is designed to fund workforce upskilling and continuous professional development. Employers in industries with at least 10 Malaysian employees are mandated to contribute, while those with 5 to 9 employees may also opt in. Employees are not required to make the contribution.

Contributions are calculated as 1% of employees’ monthly wages and are remitted to HRD Corp. This funding pool enables companies to reclaim training costs through grants that support courses, certifications, and skills programmes.

For employers, the HRD levy is not just a compliance obligation but an investment in workforce capability. By tapping into HRD grants, businesses can strengthen employee productivity and competitiveness. For employees, the levy ensures access to structured learning opportunities that advance career progression.

Employee Statutory Contributions Checklist

As an employer in Malaysia, you can follow the guidelines below to ensure you take every necessary step for compliance with statutory contributions:

Check and make sure every new hire of the company has been registered with EPF, SOCSO, and EIS, and HRDF where applicable. Any delay can result in potential penalties, fines, or even legal actions.

Calculate the statutory contributions per month in advance to ensure timely and accurate submissions of the contributions. Contributions are due by the 15th of the following month.

Transparency can strengthen the trust your employees have in the organisation. Clearly indicate the deductions on the payslips to establish transparent communication with them.

Keep a record of every receipt and supporting documents related to the statutory contributions. They are essential to internal audits and any government inspections.

The rates of every payroll statutory contribution may Stay updated on any news from EPF, SOCSO, EIS, and HRD Corp to ensure that your payroll processes reflect any updates. You must update your employees regularly to maintain trust and transparency.

Authorities may inspect all the relevant documentation from time to time to ensure compliance and accuracy of the contributions. Therefore, it’s important to gather and maintain all the essential documents for government audits.

How BoardRoom Can Help with the Administration of Employee Statutory Contributions

With various payroll statutory contributions, namely EPF, SOCSO, EIS and HRD, in place, companies and businesses must manage them effectively to ensure compliance and the welfare of employees, contributing to the overall economy of the country. Companies should conduct regular evaluations of deductions and consistently inform employees of any relevant updates to ensure more transparent communications and facilitate timely and accurate submissions.

Whether you are managing a large organisation or operating a small business in Malaysia, it can be challenging to handle the administration of statutory contributions for your employees. BoardRoom is here to support you with a professional team that is experienced in helping businesses navigate the complex statutory matters through expert advisory services. In addition, BoardRoom offers an advanced payroll system, automating all the calculations of deductions to ensure compliance and accurate submission.

Talk to BoardRoom today to learn how our payroll solutions can benefit both your business and employees today.