As Singapore moved into a post-pandemic era, the Singapore 2023 Budget focused on building capabilities and seizing opportunities in a new era of global development. The budget centred on 3 key thrusts – growing the economy, strengthening social compact and building collective resilience. We’ve summarised the key changes that you’ll need to be aware of, in order to maximise the benefits for your company.

To discover insights and updates on the tax incentives announced that will implicate your tax planning, download our Singapore 2023 Budget Report.

If you have any questions relating to the information contained in this report, please contact our tax advisors via email or call us at +65 6536 5355.

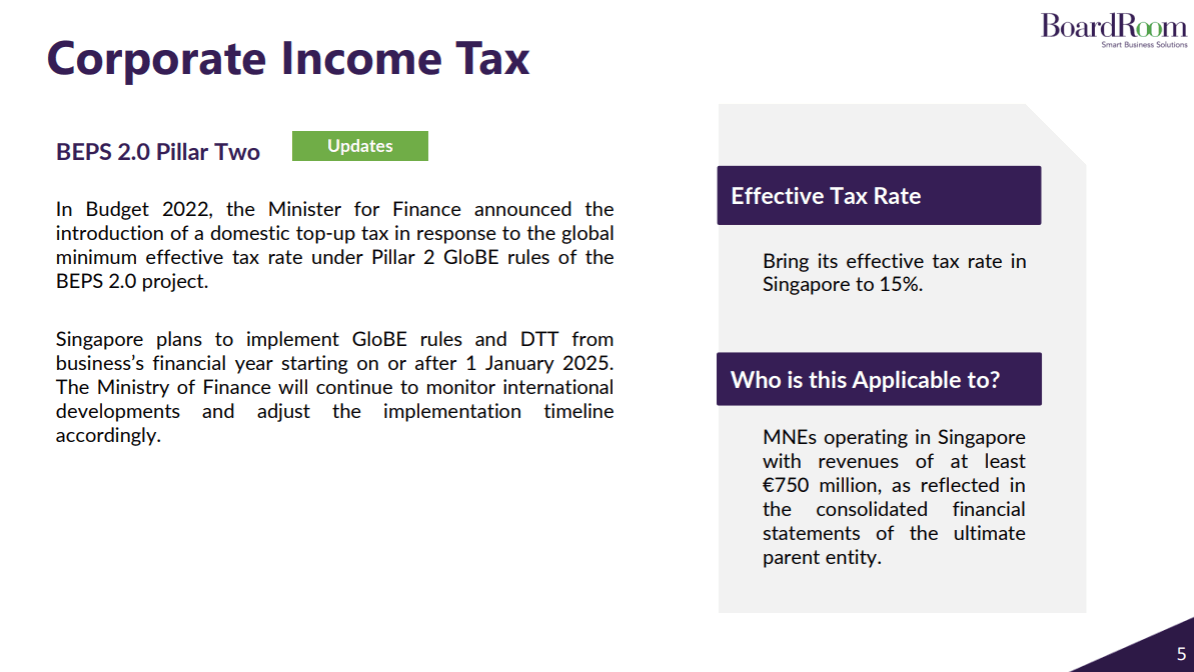

Corporate Income Tax

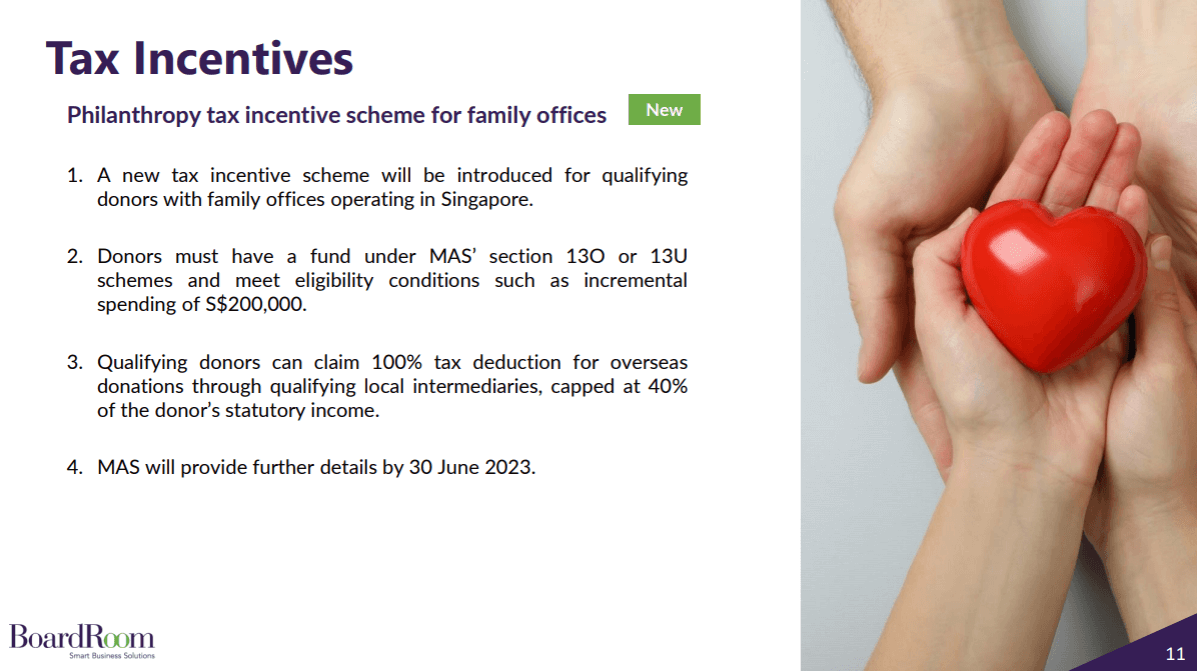

Philanthropy tax incentive scheme for family offices

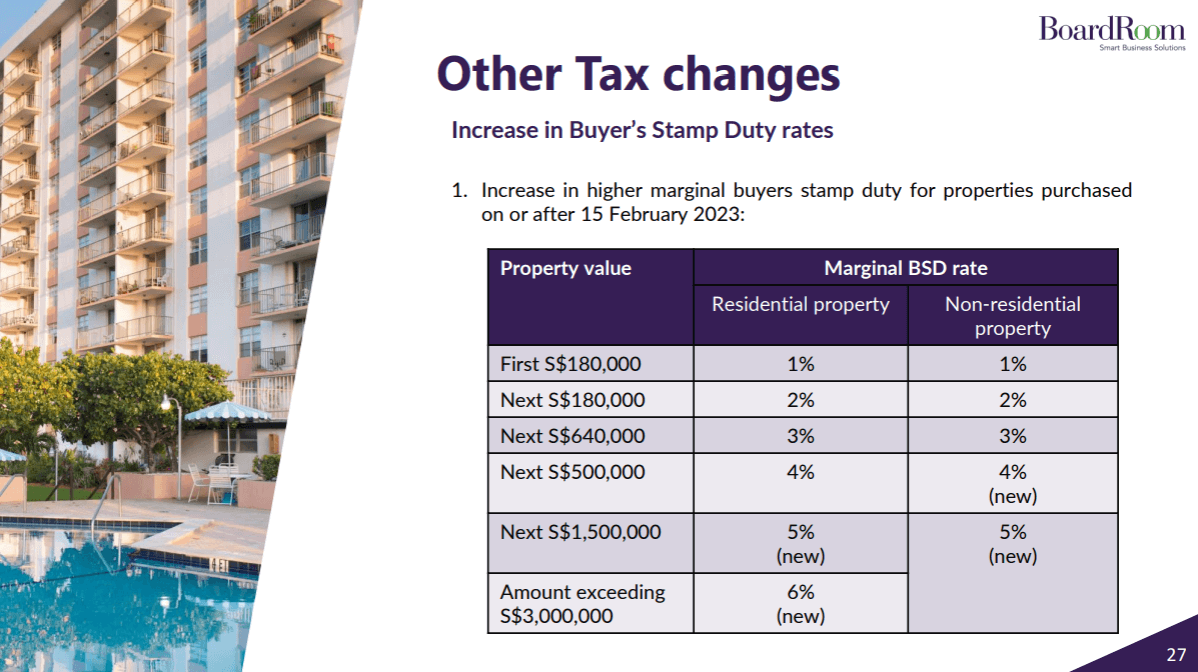

Increase in Buyer’s Stamp Duty rates

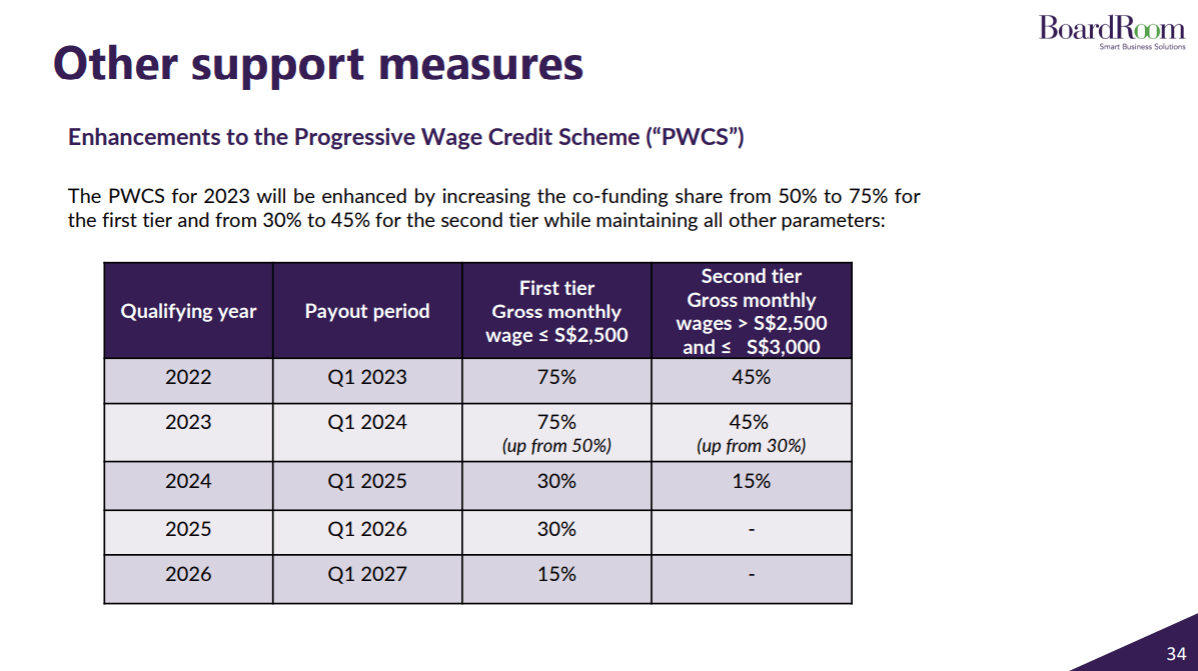

Enhancements to the Progressive Wage Credit Scheme (“PWCS”)

Related Business Insights

-

29 Sep 2025

How Smarter HR & Payroll Drive Business Growth

HR is no longer just the department that processes payslips and tracks annual leave. Today, it is a strategic drive …

READ MORE -

25 Sep 2025

How Company Tax Filing and Pre-Planning Can Be a Strategic Advantage

Discover how to move company tax filing from a compliance box-tick to a strategic advantage that reduces risk and u …

READ MORE -

24 Sep 2025

How can your business benefit from the Johor-Singapore Special Economic Zone?

Act now to benefit from the Johor-Singapore Special Economic Zone, designed to simplify cross-border trade and attr …

READ MORE