On 16th February 2021, Finance Minister Heng Swee Keat announced the Singapore 2021 Budget.

The budget this year, while focused on COVID-19 support measures, also showcases the government’s foresight as they unveiled several long-term plans such as boosting the global expansion of businesses and scaling of local organisations.

If you have any questions relating to any of the information contained in this report, please contact our tax advisors via email or call us at +65 6230 9788.

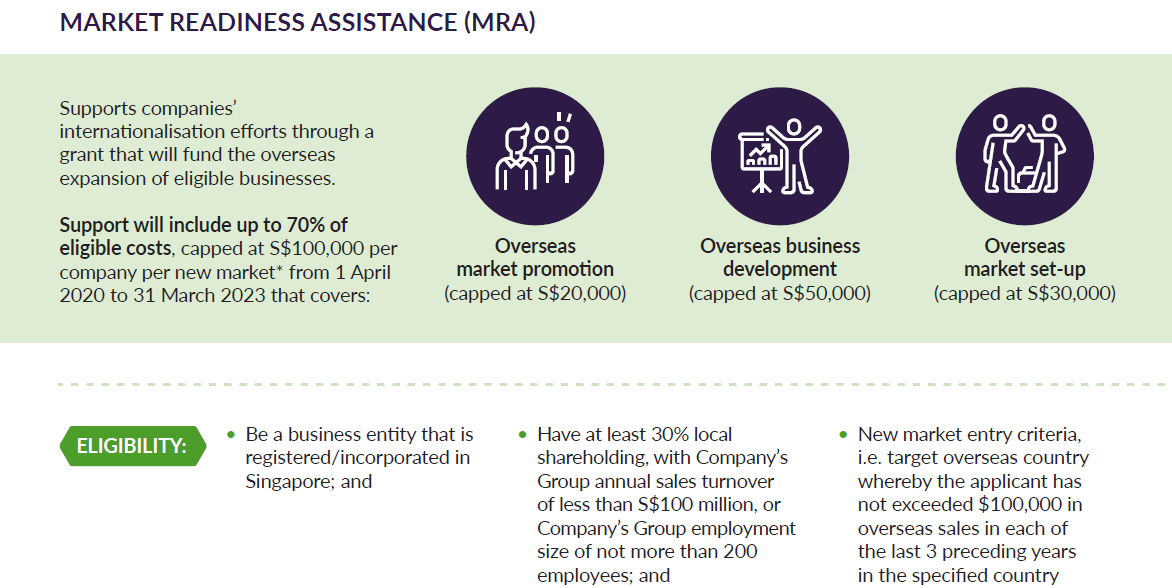

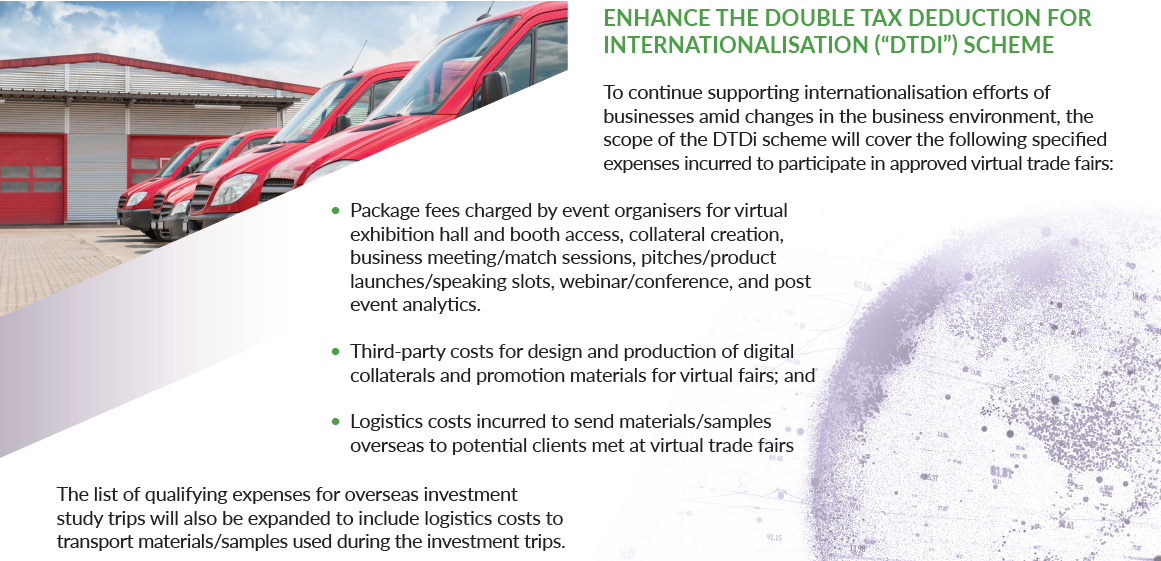

Boosting Global Expansion of Business

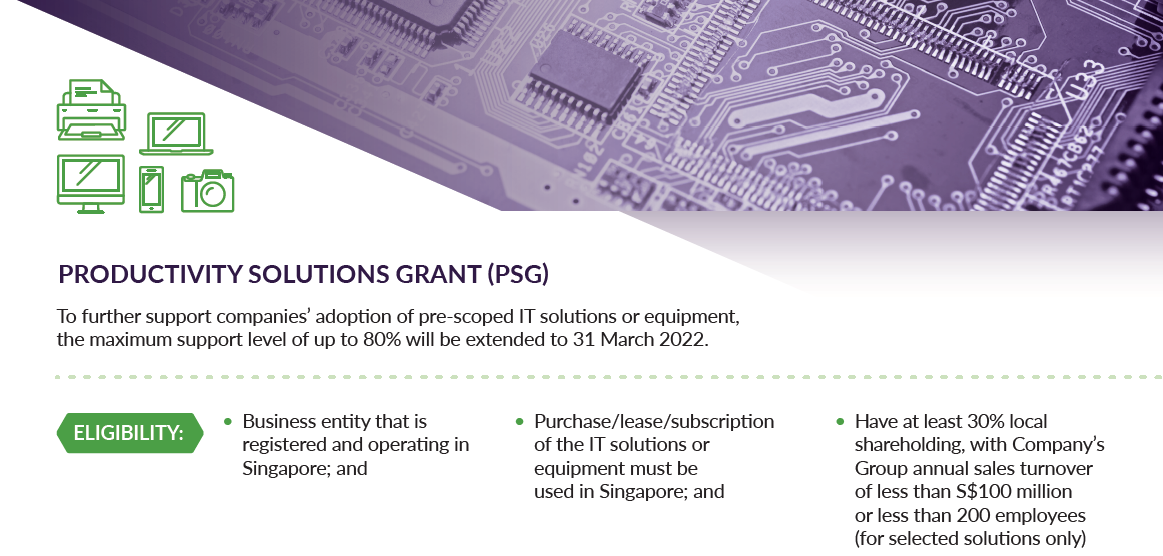

Business Scaling

Tax Support & Changes

Related Business Insights

-

29 Sep 2025

How Smarter HR & Payroll Drive Business Growth

HR is no longer just the department that processes payslips and tracks annual leave. Today, it is a strategic drive …

READ MORE -

25 Sep 2025

How Company Tax Filing and Pre-Planning Can Be a Strategic Advantage

Discover how to move company tax filing from a compliance box-tick to a strategic advantage that reduces risk and u …

READ MORE -

24 Sep 2025

How can your business benefit from the Johor-Singapore Special Economic Zone?

Act now to benefit from the Johor-Singapore Special Economic Zone, designed to simplify cross-border trade and attr …

READ MORE