On 18th February 2020, Finance Minister Mr Heng Swee Keat delivered the Singapore 2020 Budget Statement.

One of the main goals of the strategic financial plan is to grow the economy and transform Singapore’s enterprises through various packages and increased support for businesses, especially those significantly impacted by the COVID-19 virus outbreak. Overall, the Singapore Budget for 2020 aims at long term economic growth through extensive support of SMEs & start-ups. Detailed in this article are some of the changes to take note of and key government initiatives that impact SMEs to listed companies.

If you have any questions relating to any of the information contained in this 16-page infographic report, please contact our tax advisors via email or call us at +65 6230 9788.

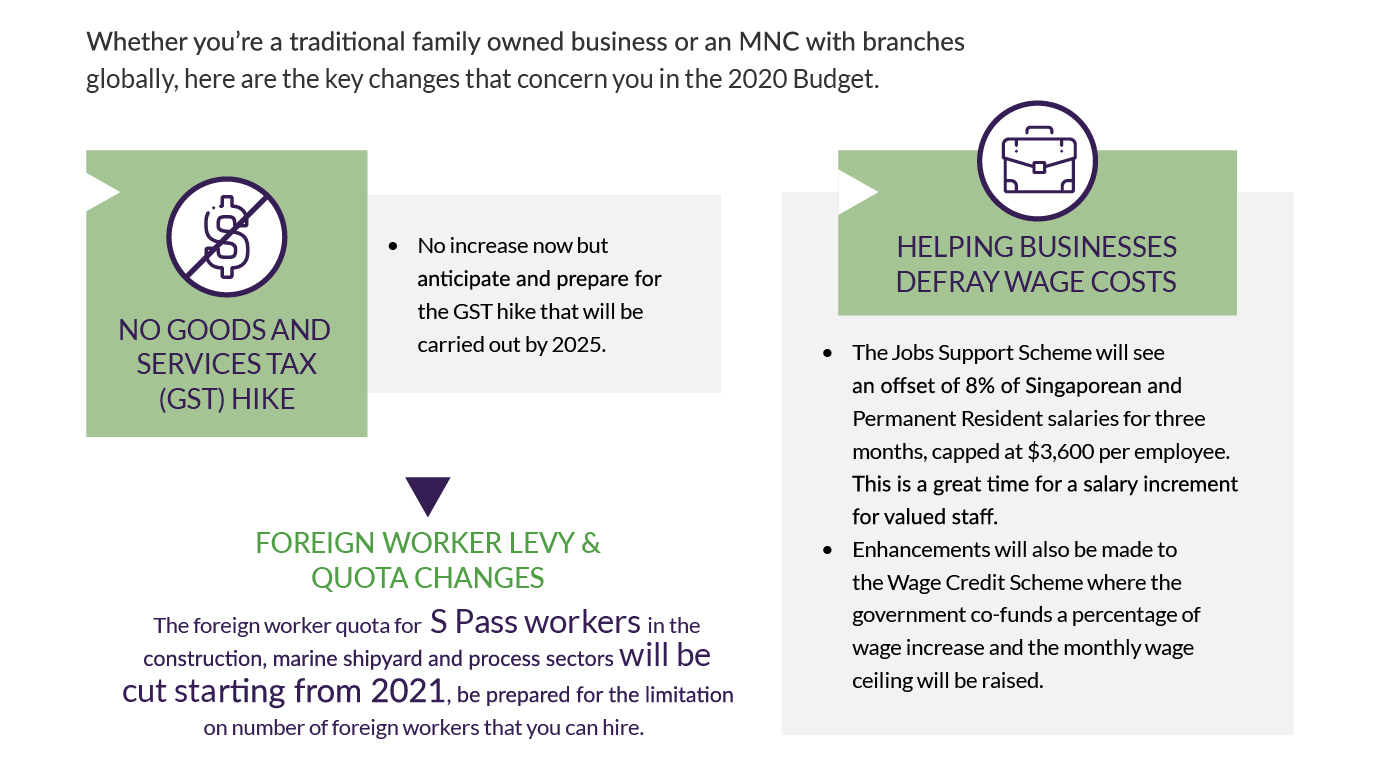

What All Enterprises Should Know

Tax Benefits All Enterprises Should Be Aware Of

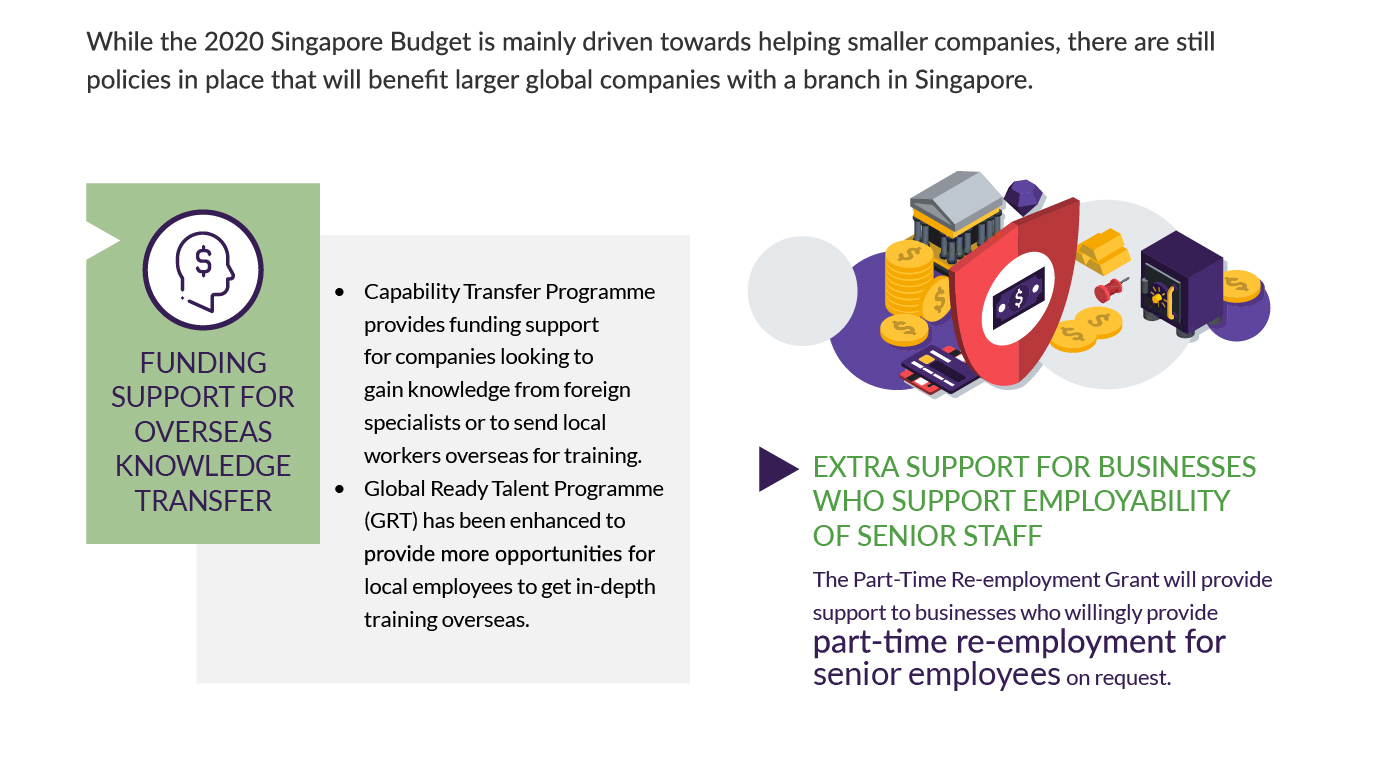

What MNCs & Listed Companies Should Know

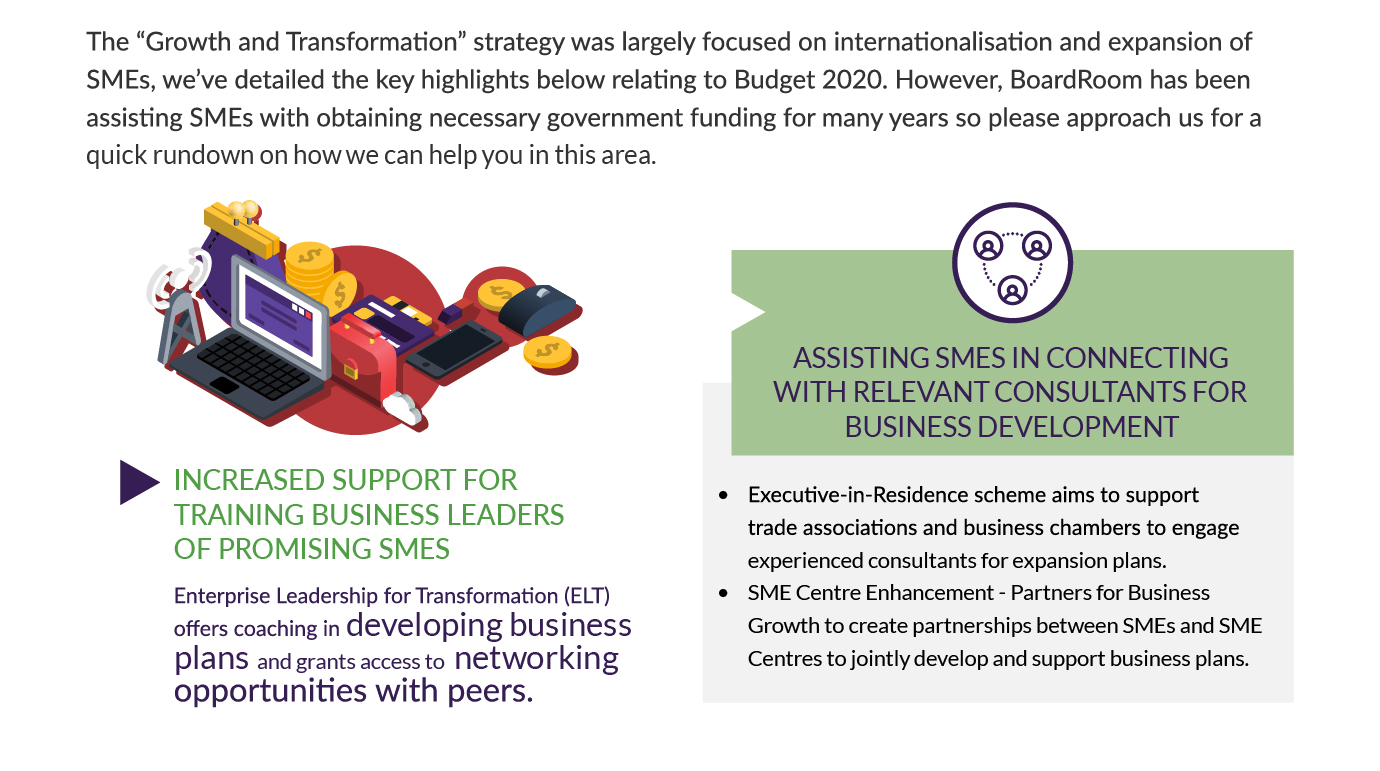

What SMEs Should Know

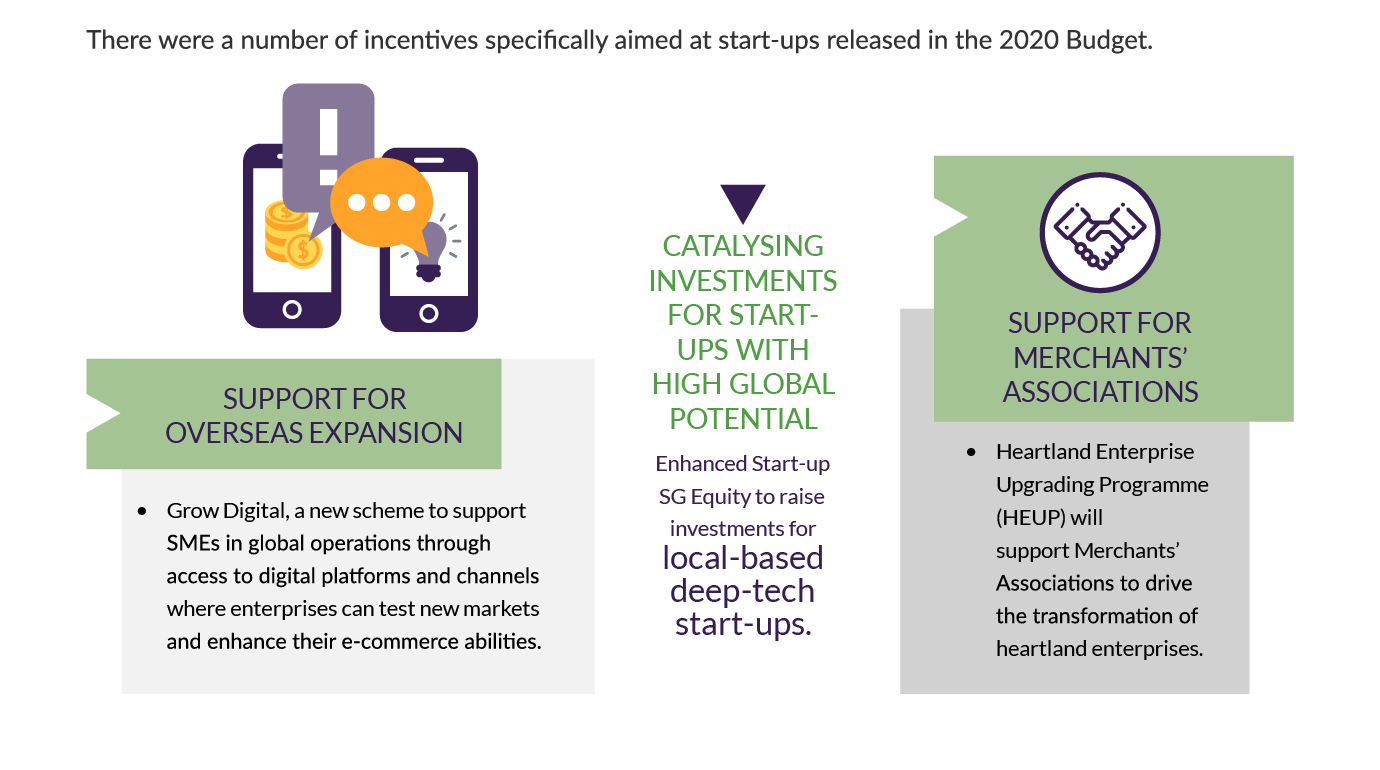

Useful information for Start-ups

Download the Full 16-page Singapore Budget 2020 Infographic Report

Related Business Insights

-

29 Sep 2025

How Smarter HR & Payroll Drive Business Growth

HR is no longer just the department that processes payslips and tracks annual leave. Today, it is a strategic drive …

READ MORE -

25 Sep 2025

How Company Tax Filing and Pre-Planning Can Be a Strategic Advantage

Discover how to move company tax filing from a compliance box-tick to a strategic advantage that reduces risk and u …

READ MORE -

24 Sep 2025

How can your business benefit from the Johor-Singapore Special Economic Zone?

Act now to benefit from the Johor-Singapore Special Economic Zone, designed to simplify cross-border trade and attr …

READ MORE